Delivering the next generation of banking

Power fintech partnerships. Reach new customers. Grow your deposits. Accelerate your revenue.

Access the world’s leading

bank operating system

Treasury Prime provides everything you need to build, launch and safely scale your business in ways that enhance the customer experience without changing how it is run.

The solution for scale. Simplify and enhance your existing technology stack through direct, real-time and seamless integration. Don’t rip and replace it.

Future growth - today. Easily expand your business offerings. Secure new technology partnerships/clients, supercharge your deposit growth, manage risk, and add capabilities with OneKey access to a network of peer institutions that can support large-scale, deposit participation programs.

Stay in control, stay compliant. Choose the clients and partners you want to work with. Control and manage the accounts and programs using your own systems and people. You’ll never have to worry about outsourcing program management to a technology firm.

Improve your oversight, processes, and controls. Enhance your compliance program, take action through an intuitive control center, and adapt to the evolving standards that regulators demand.

One banking software platform.

Unlock new growth opportunities.

Don’t bank on growth continuing to come from your existing branches, website, or mobile app. Treasury Prime’s makes it easy for banks and credit unions to access customers and deposits well beyond their existing footprint with a modern, modular Bank OS.

Direct relationships between you, your bank partners, and other service providers. No middleman blocking your growth.

Connect with the industry's largest network of banks and partner only with those that match your business' values and growth goals.

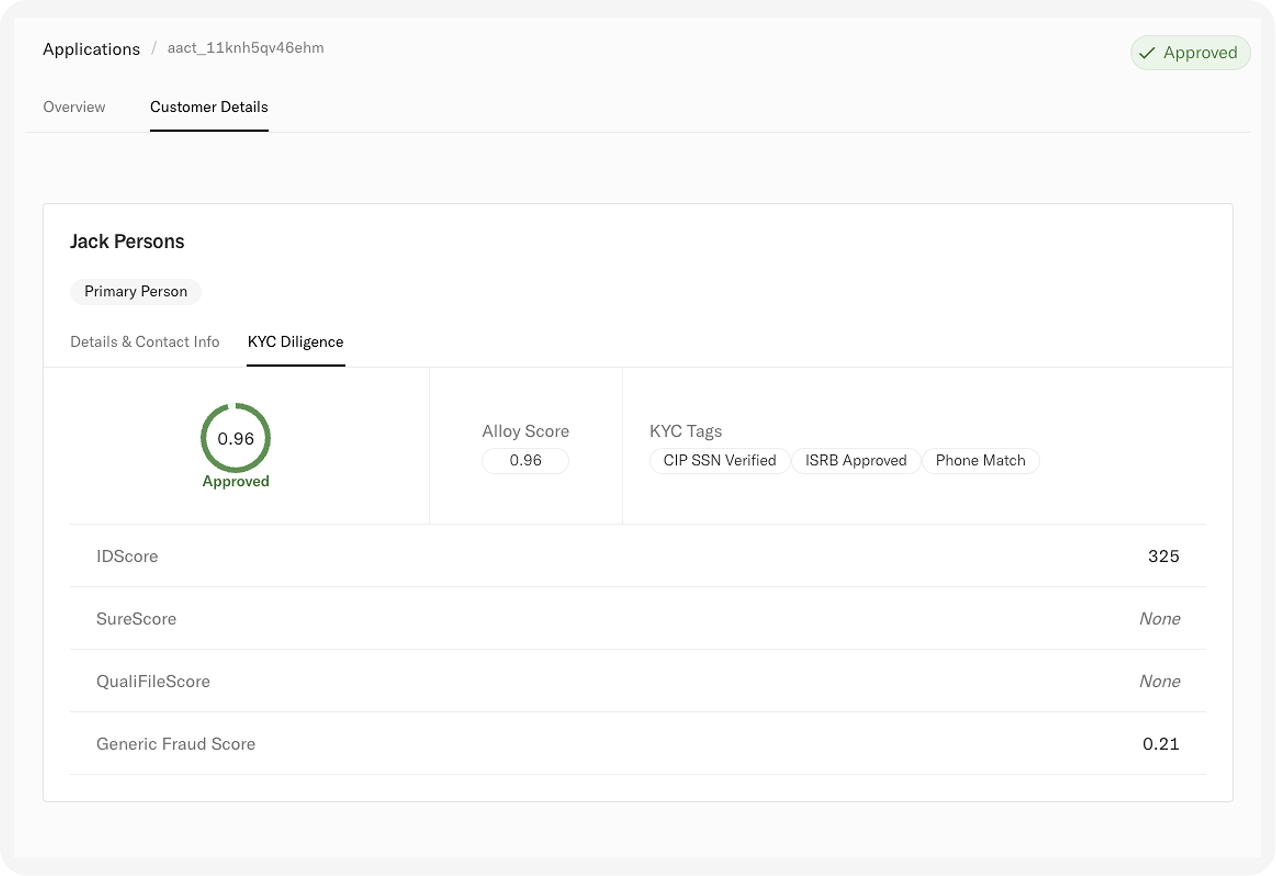

Unlock state-of-the-art partner capabilities, ranging from KYC and compliance monitoring to instant account funding and more.

Prime numbers.

Outstanding results.

Treasury Prime financial institution partners have achieved:

deposits

accounts

Build confidently with the

Treasury Prime API

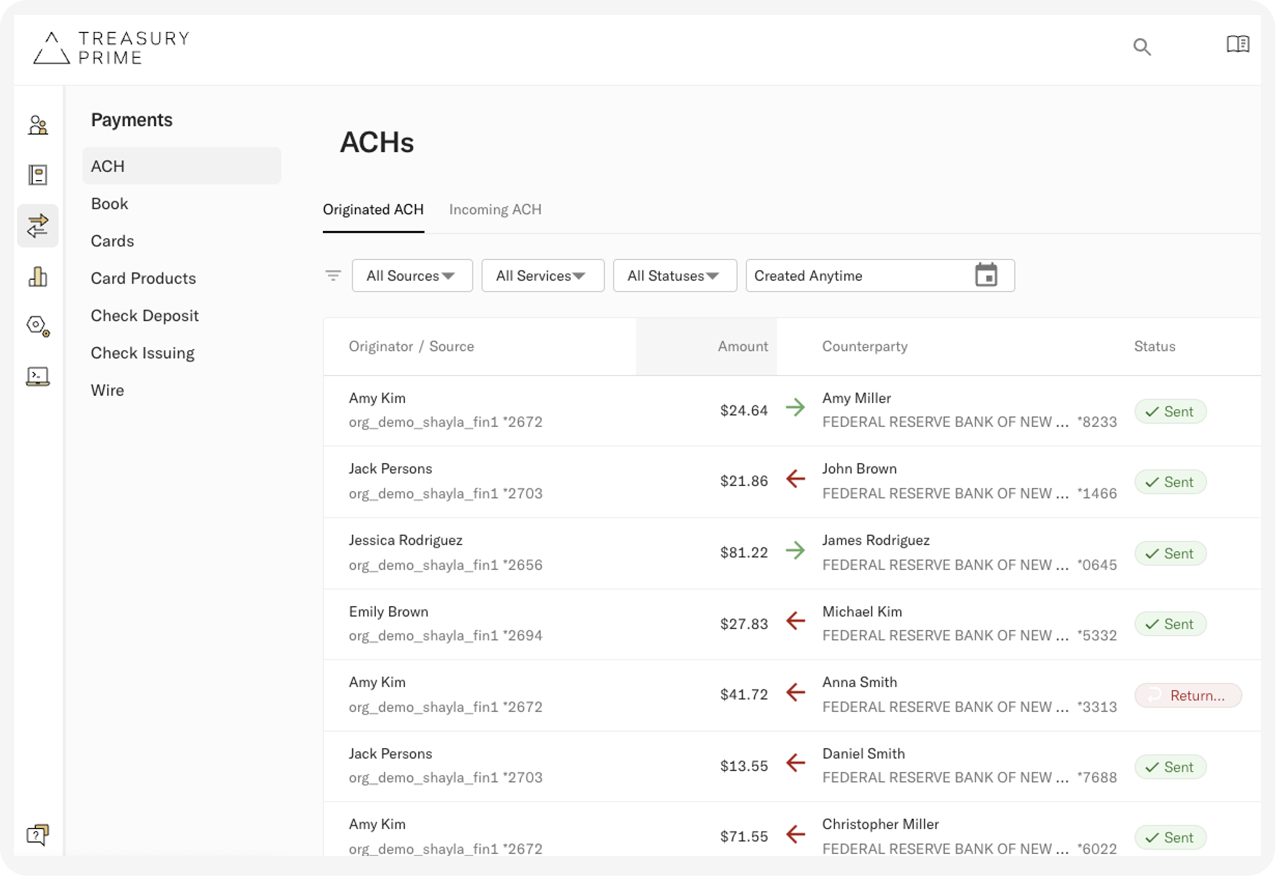

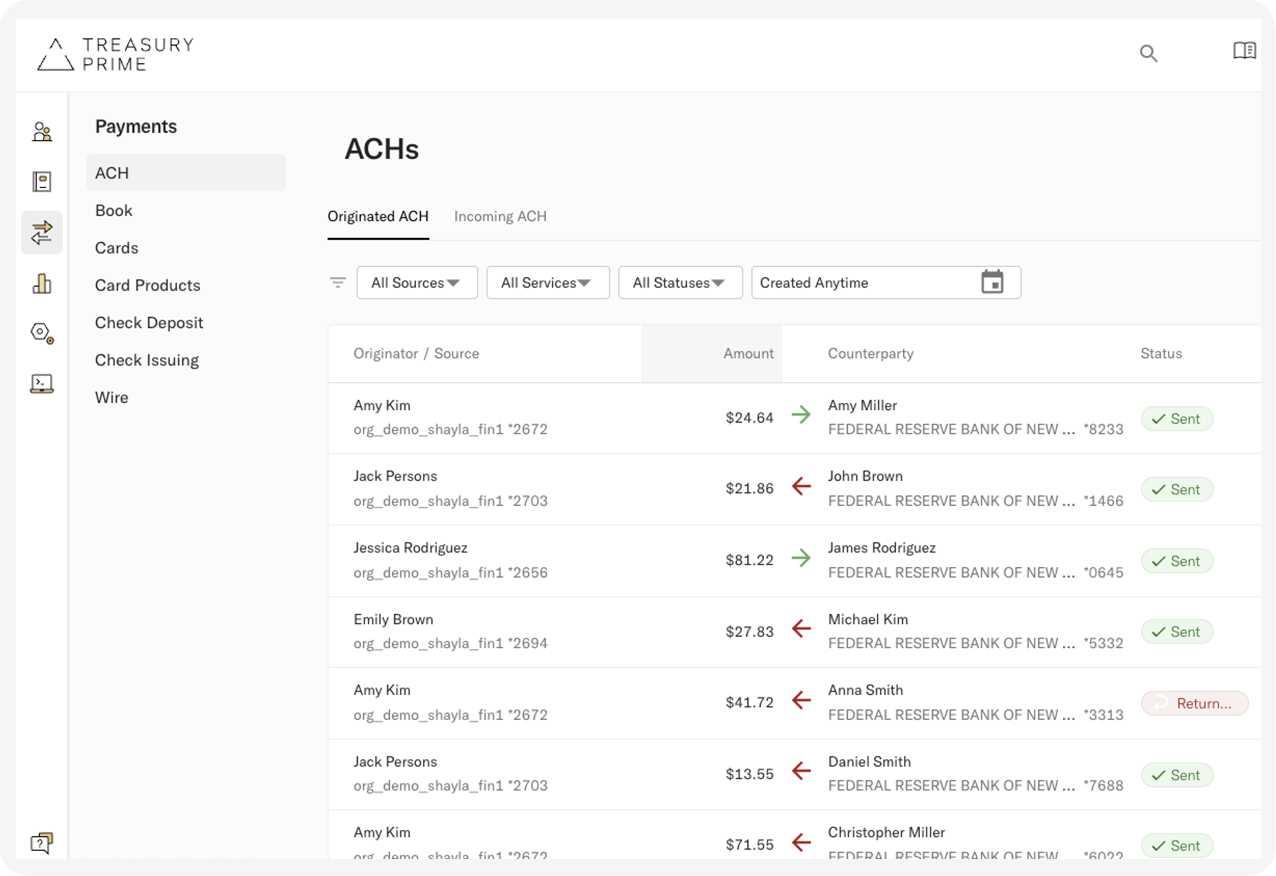

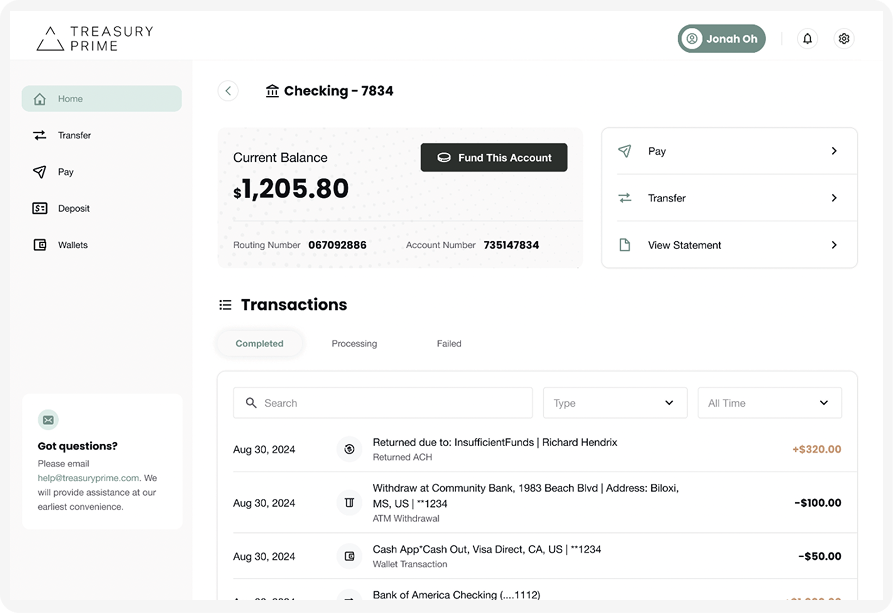

Spend your engineering time building your products, not building bank integrations. Banking is complicated, but our REST APIs are designed to be familiar, flexible, and easy to work with.

Get complete API access to your accounts, payment rails, and banking partners through our unified embedded banking API platform.

Build your own banking strategy

Treasury Prime puts you in control of your embedded banking journey. Choose the modular solutions most appropriate for your organization, and add new ones as your banking strategy and business needs evolve. We can help you:

Create amazing digital experiences

Take control over compliance

Modernize your payments

Supplement your core